Welcome

I'm Anjali, a monetization Data Scientist working my way through the realities of inference economics.

What this project isn't:

- speculation about an impending "AI bubble"

- analysis of macroeconomic impacts of AI

- strategy or advice for VCs

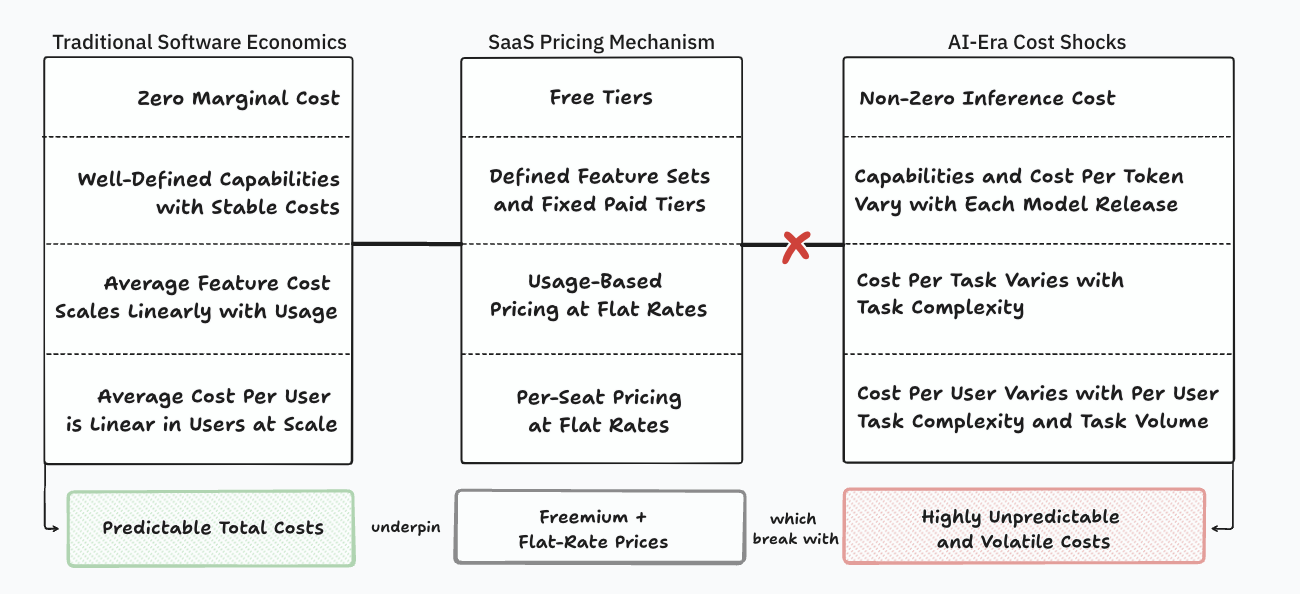

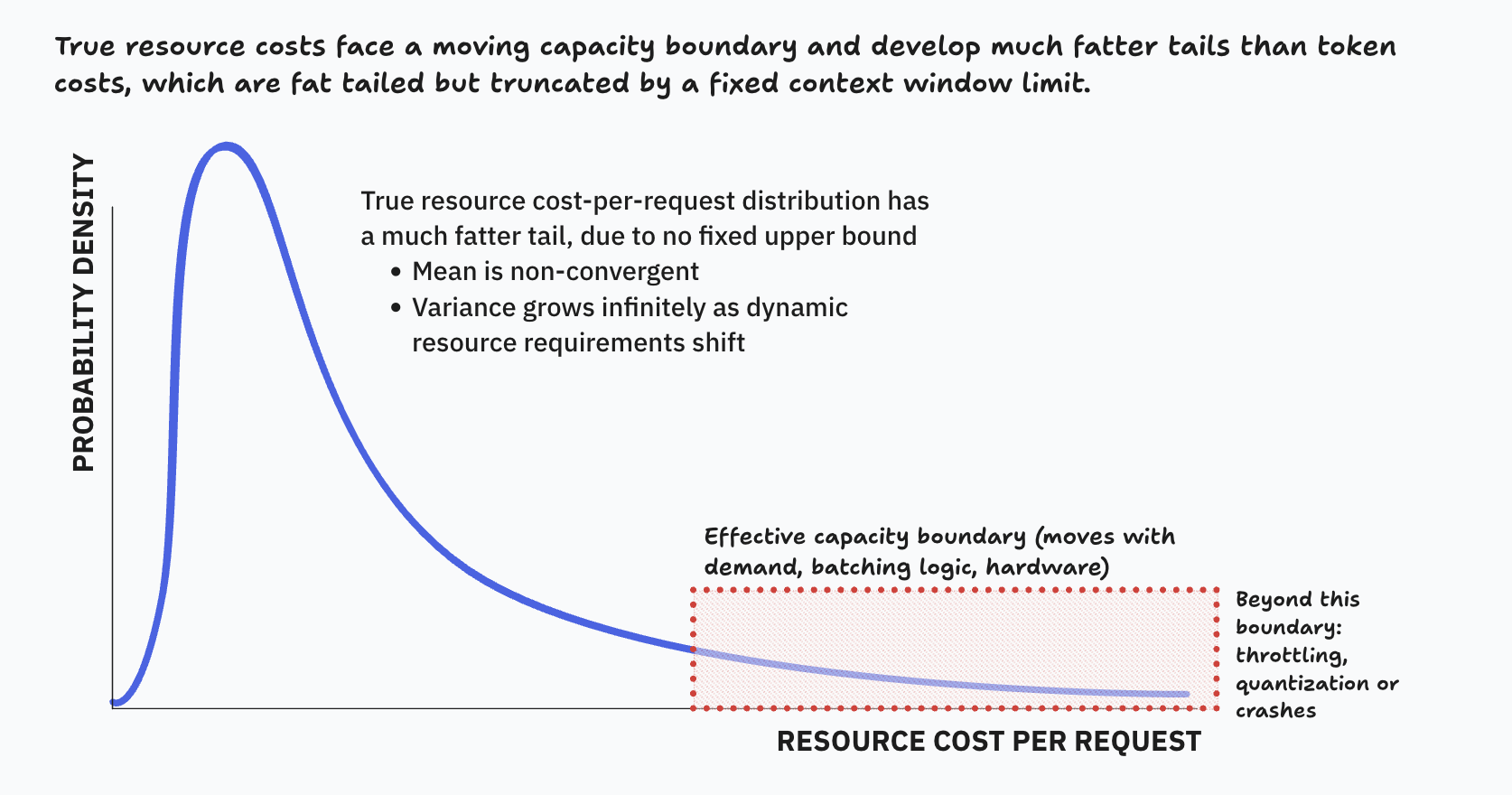

Rather, this is my attempt to describe how AI challenges SaaS economies of scale, and develop an opinion on how software pricing should evolve.